CLIENT

Manager of one of the world’s 10 largest derivatives portfolios

CHALLENGE

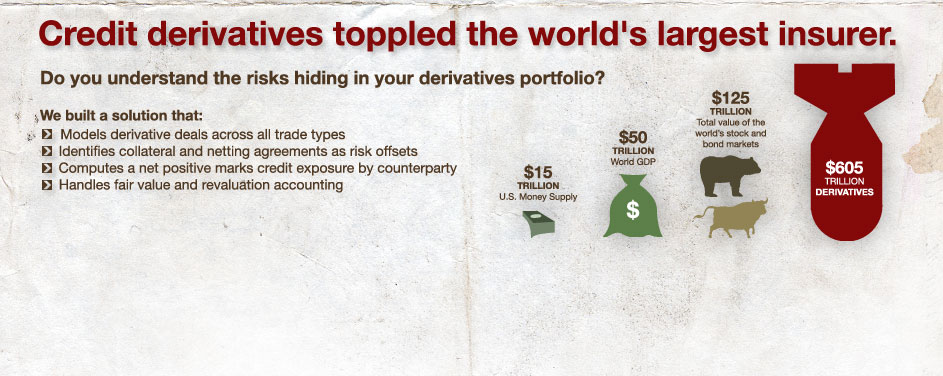

Derivatives have emerged as a prominent financial tool, employed by both financial and non-financial businesses to hedge risks, and some insurers, banks, and investment managers to increase risk. The latter often takes the form of proprietary trading, where derivatives can magnify returns through leverage, enabling sometimes extreme counterparty and asset class risk concentrations. In 2003, Warren Buffett predicted that derivatives would act as a “financial weapon of mass destruction.” Investment in derivatives grew considerably after that warning and in 2010 total notional value in outstanding derivatives contracts exceeded $600 trillion, almost 5 times the total value of the world’s stock and debt markets. To help mitigate latent downside risk, firms trading or making markets in derivatives, whether defensively as a hedge or speculatively for profit, need to closely track and actively manage the counterparty risk in their over-the-counter positions.

Our client, a large participant in FX markets, and holding risky derivatives across markets and trade types, needed a solution to comprehensively capture credit-related data on derivatives exposures across their enterprise. They turned to eBIS to analyze their book of derivatives business, captured on a multitude of tracking systems, and devise a solution for risk modeling, quantification, and reporting. The solution needed to address the following requirements:

Data Consolidation

- Consolidate trade-level data from multiple source systems into a consistent data model.

- Accommodate modeling of, and create reporting taxonomy for, all trade types and markets:

| Trade Type | Market |

| Spot | Credit |

| Forward | Equity |

| Future | Currency |

| Option | Interest Rate |

| Swap | Commodity |

| Exotic |

Credit Limit Monitoring

- Associate credit facility limit and usage calculations to individual trades.

Accounting

- Report fair value and hedge accounting as required by FASB statement 133.

- Accommodate counterparty deal accounting for structured positions. Report dominant trade notional, net exposure, and dimensionality.

- Accurately report position information to the general ledger. Some derivatives product systems lack a mechanism to accurately post a marked-to-market and notional balance.

Exposure Quantification

- Facilitate capture of credit risk mitigants (netting, collateral), offset permissions and their associations to exposures.

- Report positive marks after netting and potential future exposure calculations for internal analysis of downside credit risk and profit contribution.

- Provide trade-level details for calculation of a Basel II-compliant current exposure value.

Trade Management

- Provide a method to effectively eliminate reporting of trades between internal desks.

- Identify hedge trades and the portfolio exposures being hedged.

- Capture all derivatives data, identifying OTC positions separate and distinct from those trades executed on, and guaranteed by, exchanges.

IDEAS

We analyzed each requirement and formulated design ideas to address each need.

Data Consolidation

- Create a single, custom-built data store for integration of all product systems.

- Use 3 trade attributes: family, type, and sub-type to drive selection criteria for reporting and analysis of other data elements

Credit Limit Monitoring

- Use facility identifier on trades to enable calculation of usage and remaining available credit

Accounting

- Initiate a back office accounting project to calculate FAS 133 fair value for requisite trade types, including cash flow and foreign currency hedges.

- Establish a back office process to properly identify a dominant trade notional within a structured deal and consolidate its mark-to-market accounting. Deliver dimensional information, including product, with accounting balances to categorize the position.

- Initiate a back office reengineering project, centering on a product system upgrade, to improve the GL posting process for revalued OTC mark-to-market calculations and FX trade notional values.

Exposure Quantification

- Create a mitigation data model to capture rules for netting trades and assigning collateral to netting agreements.

- Calculate a positive marks after netting balance and potential future exposure value per counterparty credit facility for internal credit reporting.

- Use trade-level attributes for Basel II current exposure method calculation, leveraging mitigation relationships and notional and MTM balances assigned to trades.

Trade Management

- Use trade-level attributes of customer and department to determine if a given trade originated between desks within the same business unit. If so, exclude it from credit analysis.

- Instruct traders to flag trades for hedge accounting. Use a reference customer, facility or bond ticker to identify the exposures being hedged.

- Comprehensively consolidate derivatives trades for FFIEC reporting, and use the customer and facility identifiers to segregate those positions traded over-the-counter and thus relevant for counterparty risk analysis.

SOLUTION

eBIS delivered the derivatives analysis solution that our client required. It provided a centralized derivatives model and reporting platform, incorporating requirements across all stakeholders: trading desks, the derivatives back office, credit portfolio management, regulatory reporting, finance quality assurance, and management accounting. We carefully analyzed reporting needs, developed ideas, and then delivered a derivatives monitoring and reporting solution embraced by all of these internal clients at the bank for the first time.

Of particular note, the solution enabled:

- Accurate counterparty credit risk monitoring, including concentration risk analysis

- Comprehensive FFIEC reporting of all derivatives positions

- Calculation of economic credit capital

- Calculation of Basel II regulatory capital through the Current Exposure Method

- Quantitative Impact Study (QIS) scenario analysis

- Capital relief through identification of swap hedge positions

RESULTS

Derivatives were cast as a central character in the Global Credit Crisis. AIG issued credit derivatives in excess of $2 trillion, requiring a taxpayer bailout. Merrill Lynch created off balance sheet SIVs for selling CDOs that it then guaranteed with total return swaps, eventually leading to its forced merger. At the time of its collapse, Lehman Brothers had derivatives contracts in place with over 8,000 counterparties, many of whom were not fully repaid pledged collateral or compensated for a positive marks position. As the crisis spread, it became clear that some firms were not monitoring and managing the counterparty risk in their derivatives exposures effectively.

Post-crisis, financial firms continue to deal extensively in derivatives, with JP Morgan, the U.S.’s largest dealer, holding contracts worth over $75 trillion in notional value on 30 June 2010.

In this context, eBIS helped our client understand crucial components of their derivatives risks through the credit crisis and beyond. The net effect? For our client, the financial weapon of mass destruction appears much more manageable.